Title Insurance Costs by State — Interactive Map & Savings Calculator

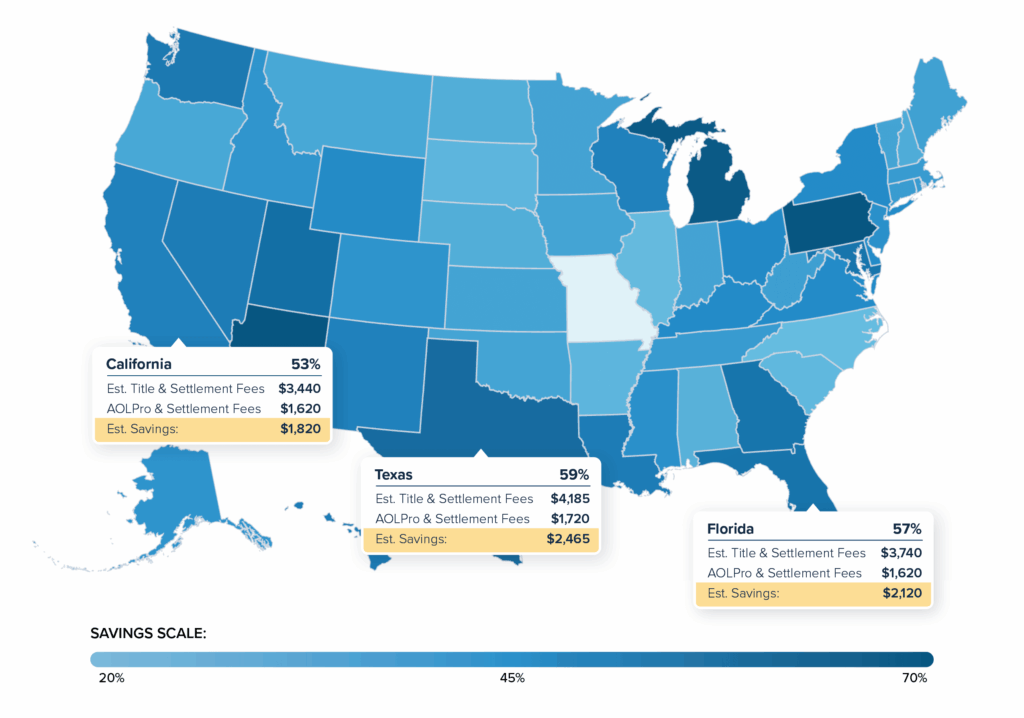

Title insurance costs can vary dramatically by state—the same $475,000 transaction that costs $1,334 in Missouri will run $4,716 in Pennsylvania. Yet most buyers, and even some loan officers and real estate agents, don’t realize there’s room to negotiate or explore affordable alternatives like AOLPro. Our interactive map reveals title-related closing costs across all 50 states, whether you’re working with a purchase or refinance. Simply click any state to see how traditional home title insurance costs stack up against our fully insured attorney opinion letter alternative.

Figures are illustrative based on common fee structures—actual quotes vary by provider, county, and loan details.

Title Insurance Costs & AOLPro Savings by State: Interactive Map

How to Use This Interactive Home Title Insurance Cost Map

Getting the most out of our cost comparison tool is straightforward; just follow these four simple steps to uncover potential savings in your state.

Step 1: Select Your Transaction Type

Start by choosing between “Purchase” and “Refinance” at the top of the map. Here’s why this matters: purchase transactions typically cost significantly more because you’re protecting two parties (yourself and your lender) with separate policies. Refinances usually only require a new lender’s policy, which keeps costs lower.

Step 2: Choose Your Loan Amount

Select either $275,000 or $475,000 to see cost estimates for that price range. The map displays costs proportionally — higher-value properties will incur correspondingly higher fees. (For purchase scenarios, we’re assuming owner’s coverage on properties valued around $300,000 or $500,000, respectively.)

Step 3: Decode the Color-Coded States

Each state displays in different shades of blue based on potential AOLPro savings:

- Dark blue: Maximum savings potential (Pennsylvania, Texas, Florida, and California)

- Medium blue: Solid savings opportunities (covers most states)

- Light blue: More modest savings (Missouri, Indiana, Wyoming)

Step 4: Compare Traditional Home Title Insurance Costs vs. AOLPro Costs

The sidebar will display total estimated closing costs for both options — traditional title insurance and AOLPro — including all typical settlement fees, title searches, and related charges. Depending on the state, savings with AOLPro can range from about 14% in competitive markets up to an impressive 66% in high-cost states.

What’s Included in These Numbers: Our estimates cover the full scope of title-related closing costs you’ll encounter:

- Title insurance premiums (or AOLPro fees) – including the owner’s policy for purchases

- State-specific endorsements that may be required

- Title commitment and abstract fees where applicable

- Local county or municipal transaction taxes and fees, if applicable

- Settlement and closing fees (whether handled by escrow or attorney)

- Title search and examination costs

- Closing protection letter (CPL) fee

- Courier and wire transfer fees for handling payoffs and funding

Pro Tips for Maximum Impact

Scenario Planning: Don’t just check one state—explore multiple scenarios. For instance, that Texas refinance on a $475,000 property? You’re looking at roughly $2,533 in potential savings with AOLPro.

For Loan Officers and Agents: This map becomes invaluable during pre-qualification conversations and Closing Disclosure reviews. Use it to set realistic expectations and show clients a credible path to lower closing costs.

Important Reality Check: These figures represent current typical market rates for title services. Your actual costs may vary based on the specific title company you choose, property complexity, and local market dynamics. Some properties require additional endorsements or extensive title work that can bump up fees. AOLPro is available in all 50 states.

Your Title Costs Could Be

With an AOLPro?

Why Most Homebuyers Overpay for Title Insurance (And How to Avoid It)

Here’s an uncomfortable truth: most homebuyers hand over thousands for title insurance without realizing they have options. The industry’s marketing focuses on lenders and real estate professionals—not borrowers. Transparency on rate-setting is limited, and charges often get bundled with other closing costs, leaving buyers in the dark about what they’re actually paying for (U.S. Department of the Treasury).

But federal law is on your side. The Consumer Financial Protection Bureau explicitly encourages borrowers to compare title services listed on the Loan Estimate, and you have the legal right to shop around. Here’s your roadmap to significant savings:

Ask About Reissue Rate Discounts (Save Up to 40%)

This is one of the most overlooked money-savers in real estate: reissue rate discounts can slash your title insurance costs by up to 40%, yet most consumers have never heard of them. The U.S. Department of Treasury’s comprehensive analysis found that “borrowers who are not aware of the availability of simultaneous issue or reissue discounts may be charged undiscounted rates” and noted that title industry practices don’t prioritize educating buyers about these substantial savings opportunities.

When Reissue Discounts Apply:

- Purchases: If the seller has a prior owner’s policy within your state’s look-back window (often ranging from a few years to 10 years), you may qualify for reduced premiums on both owner’s and lender’s coverage.

- Refinances: Your existing loan policy often triggers a reissue credit on the new lender’s policy. But we have seen borrowers charged the full amount on refinances, so don’t be shy and ask for a discount.

What to ask for / name the discount

- Don’t wait for someone to mention it. Specifically request the “reissue rate,” “reissue credit,” “refinance rate,” or “substitution rate”—terminology varies by state and insurer.

Proof is Essential

- You or the previous owner must provide a copy of the prior title insurance policy (declarations page) if you have it; if not, ask your title agent/attorney to help locate evidence of prior coverage to prove eligibility. Some states/insurers require a copy to apply the discount.

Bundle Policies for Simultaneous Issue Savings

When you buy owner’s and lender’s title insurance at the same closing, the title work overlaps—and so should your savings. Most states offer “simultaneous issue” discounts on the second policy.

- Real example: In New York, when policies are issued together, the loan policy up to the owner’s coverage amount is charged at just 30% of the normal loan rate (Department of Financial Services). Similar savings exist nationwide, but you may have to ask.

Shop Multiple Providers (Where Competition Exists)

In most states, both rates and service fees vary between providers, sometimes significantly. Since you control this choice, comparing quotes can deliver real savings.

- Under RESPA Section 9, sellers cannot require a specific title company as a condition of sale (Consumer Financial Protection Bureau).

- CFPB guidance confirms you may choose a provider not on your lender’s preferred list, as long as the lender will work with them (Consumer Financial Protection Bureau).

Understand Who Pays What (It’s Negotiable)

Here’s something many agents won’t tell you: who pays for owner’s versus lender’s title insurance is a matter of local custom, not law. Everything is negotiable in your purchase contract.

- Regional examples: In California, sellers typically pay the owner’s policy in Southern California, while buyers commonly pay it in Northern California. Buyers usually handle the lender’s policy statewide—but parties are free to negotiate different arrangements (California Department of Insurance).

- State-Specific Practices: These customs vary dramatically by state and even by region within states. Some areas traditionally expect sellers to pay for owner’s policies, while others place this cost on buyers. Research your local market norms, but remember—these are customs, not legal requirements, so everything remains negotiable in your purchase contract. (Old Republic Title)

Consider Attorney Opinion Letters for Simplified Savings

If navigating reissue rates and shopping multiple providers sounds overwhelming, there’s a streamlined alternative. AOLPro offers a fully insured attorney opinion letter, which combines owner’s and lender’s coverage for one flat fee, delivering substantial savings.

- Fannie Mae permits attorney title opinion letters (AOLs) in place of lender’s policies for certain loans, and refinance borrowers have averaged over $1,000 in savings when AOLs were used (Fannie Mae).

- Independent risk assessments have found Alita’s AOLPro framework materially similar to traditional title insurance from a credit-risk perspective (bradley.com).

The bottom line: Home title insurance costs don’t have to be a mystery expense. Armed with these five strategies, you can approach your closing with confidence and keep more money in your pocket where it belongs.

Why Home Title Insurance Costs Vary Dramatically by State

Ever wonder why the same property transaction costs $1,334 in Missouri but $4,716 in Pennsylvania? Title insurance pricing isn’t random—it’s driven by each state’s regulatory approach, local market dynamics, and how key fees are structured. Understanding these factors helps you know when shopping around will actually save money versus when you should focus on other strategies.

1. Government-Set Rates vs. Competitive Markets

The biggest factor determining your savings potential is whether your state sets uniform rates or allows companies to compete on price.

Promulgated Rate States (Limited Competition) A handful of states require every title company to charge identical base premiums. In these markets, shopping won’t save you money on the core insurance premium, but you can still negotiate service quality and ancillary fees.

Key promulgated rate states:

- Texas: Uses a detailed rate manual with built-in refinance credits (Texas Department of Insurance)

- Florida: Operates under Rule 69O-186 for standardized pricing (Florida Office of Insurance Regulation)

- New Mexico: Maintains promulgated forms and rates (New Mexico Public Regulation Commission)

Competitive Rate States (Shopping Matters) Most states allow filed or competitive pricing, meaning companies can differentiate on cost. Here, comparing total quotes from multiple providers can deliver significant savings on both premiums and service fees.

2. Owner’s Policy vs. Lender’s Policy: Know What You’re Buying

Understanding the difference between these two policies is crucial for smart decision-making:

Lender’s Policy (Usually Required)

- Protects your mortgage lender’s interest

- Coverage amount decreases as you pay down the loan

- Required by nearly all lenders for conventional loans

Owner’s Policy (Optional but Recommended)

- Protects your equity and ownership rights

- Coverage remains constant for as long as you own the property

- Strongly recommended by the Consumer Financial Protection Bureau

Cost rule of thumb: Owner’s policy plus related title services typically total 0.5%–1.0% of the purchase price, varying significantly by state and loan size (Urban Institute).

3. Regional Payment Customs: A Key Driver of Cost Perception

As we covered earlier, who pays for title insurance is custom, not law—but these regional traditions significantly impact how costs are perceived and structured in different markets (Bank Rate)

Why This Affects State-by-State Variations:

- Seller-pay regions: often bundle title costs into listing prices, making them less visible to buyers

- Buyer-pay markets: create more direct cost awareness and shopping incentives

- Split arrangements: can create confusion about “typical” costs within the same state

The Strategic Takeaway: When comparing our state-by-state cost data, remember that your actual out-of-pocket expense depends heavily on local negotiating customs. A “high-cost” state where sellers traditionally pay may be more affordable for buyers than a “low-cost” state where buyers bear all title expenses.

This is why understanding your local market customs (through your agent or title companies) gives you negotiating leverage regardless of your state’s overall cost ranking.

4. Property Values and Risk Factors That Drive Costs

While premiums scale with coverage amounts, several other forces push costs up or down:

State and Municipal Factors:

- Transfer taxes and recording fees

- Required endorsement types

- Regulatory oversight complexity

Market Risk Elements:

- Urban vs. rural complexity levels

- Historical fraud risk in the area

- Competition among title providers

- Local attorney vs. escrow closing customs

This explains why states with similar home values can have vastly different total title costs (Urban Institute).

5. Strategic Negotiation: Turn Savings Into Leverage

In Seller-Pay Markets: If local custom has the seller covering the owner’s policy, you can turn title savings into negotiating power. Propose a lower-cost alternative (like AOLPro) and request the savings back as:

- Closing cost credits

- Repair allowances

- Purchase price reductions

In Any Market: You can always request concessions or cost-sharing on shoppable title services. Since you control the title company selection in most cases, use this leverage strategically in your negotiations (Bankrate).

The Bottom Line: Understanding your state’s regulatory environment and local customs gives you the knowledge to navigate title costs strategically. In competitive markets, shop aggressively. In promulgated rate states, focus on service quality and negotiate ancillary fees. Either way, remember that most title-related costs are more flexible than they initially appear.

Title Insurance Costs by State: Complete Data Breakdown

The numbers reveal a shocking reality about America’s title insurance market. Identical $475,000 transactions can cost anywhere from $1,334 to $4,716, depending solely on which state you’re buying in—a striking 3.5x variation that has nothing to do with the actual protection you receive.

These figures represent the average title costs you’ll encounter at closing, encompassing all title policies, searches, endorsements, settlement fees, and applicable state taxes. As our interactive map demonstrates, geography dramatically impacts your out-of-pocket expenses.

1. Highest Cost States: Where Title Insurance Hits Hardest

The most expensive states combine multiple cost-driving factors: complex regulatory environments, high property values, extensive endorsement requirements, and limited competition among providers.

|

Rank |

State |

Title Insurance Costs ($475k) |

AOLPro Savings |

|---|---|---|---|

|

1 |

Pennsylvania |

$4,716 |

66% |

|

2 |

Arizona |

$4,707 |

66% |

|

3 |

Michigan |

$4,555 |

64% |

|

4 |

Georgia |

$4,270 |

56% |

|

5 |

Texas |

$4,185 |

59% |

|

6 |

Utah |

$3,861 |

58% |

|

7 |

Florida |

$3,740 |

57% |

|

8 |

Maryland |

$3,685 |

56% |

|

9 |

Washington |

$3,609 |

55% |

|

10 |

Nevada |

$3545 |

54% |

|

11 |

Hawaii |

$3530 |

54% |

|

12 |

Louisiana |

$3518 |

54% |

|

13 |

California |

$3,440 |

53% |

|

14 |

Wisconsin |

$3428 |

53% |

|

15 |

New Mexico |

$3,417 |

53% |

|

16 |

Ohio |

$3268 |

50% |

|

17 |

Wyoming |

$3234 |

50% |

|

18 |

Kentucky |

$3218 |

50% |

Why These States Cost More: Pennsylvania and Arizona top the list due to complex title requirements and high settlement fees. Texas, despite government-regulated rates we discussed earlier, ranks fifth because of comprehensive coverage mandates and additional regulatory fees. These markets show the greatest potential for AOLPro savings, often exceeding 50% of traditional costs.

2. Lowest Cost States: Where Competition and Simplicity Win

The most affordable states typically feature streamlined property laws, competitive title markets, and fewer mandatory endorsements—exactly the factors that make shopping around more effective.

|

Rank |

State |

Title Insurance Costs ($475k) |

AOLPro Savings |

|---|---|---|---|

|

1 |

Missouri |

$1,334 |

-21%* |

|

2 |

Illinois |

$2,063 |

21% |

|

3 |

Arkansas |

$2,145 |

24% |

|

4 |

South Dakota |

$2,155 |

25% |

|

5 |

Alabama |

$2,205 |

27% |

|

6 |

Nebraska |

$2,263 |

28% |

|

7 |

New Hampshire |

$2,305 |

30% |

|

8 |

North Carolina |

$2,345 |

20% |

|

9 |

Maine |

$2,555 |

37% |

|

10 |

Tennessee |

$2,689 |

40% |

*Missouri’s unique position: Missouri’s exceptionally low traditional title costs actually make AOLs more expensive—a rare market where conventional title insurance represents the better value.

3. Regional Patterns and Strategic Implications

Geographic Clusters: The data reveals clear regional advantages. Midwest and Southern states dominate the low-cost rankings, while Western and Northeastern states cluster toward higher costs. This pattern reflects both regulatory complexity and market concentration among title providers.

Strategic Insights:

- High-cost state buyers should prioritize the alternative options we’ve outlined, particularly AOLPro which shows 50%+ savings potential

- Low-cost state buyers can focus on the shopping and discount strategies covered earlier, as absolute dollar savings may be more modest

- Border state considerations: If you’re near state lines, understanding neighboring state costs can inform location decisions for investment properties

The Bottom Line: Your state’s position on these rankings directly impacts which cost-reduction strategies will deliver the most value. Use this data alongside our earlier guidance on reissue discounts, shopping strategies, and negotiation tactics to optimize your approach for maximum savings.

Save on Title Insurance Costs with an Insured Attorney Opinion Letter (AOLPro)

As we’ve explored the various ways to reduce traditional title insurance costs by state, there’s a little-known alternative that bypasses much of that complexity entirely. AOLPro represents a tech-enabled approach to title risk management that can deliver the savings we’ve discussed as well as a cheap title insurance alternative through a single, flat-fee solution.

1. How AOLs Work: Same Process, Different Delivery

AOLPro uses identical title search, examination, and curative procedures as traditional title insurance companies. The key difference? Instead of issuing a policy, they deliver an insured attorney title opinion backed by A.M. Best A-rated insurance carriers.

The streamlined advantage: One flat fee covers both lender, homebuyer, and future investor needs in a single document, in both purchase and refinance transactions.

2. Market Validation and Track Record

GSE Acceptance: Both Fannie Mae and Freddie Mac permit AOLs under specific conditions, with Fannie Mae reporting over 10,000 AOL loans purchased since 2009 with zero title-claim losses (Fannie Mae).

Independent Risk Assessment: Credit rating agencies like Moody’s have evaluated AOLPro and found it comparable to traditional title insurance from a credit-risk perspective (The Title Report).

Real-World Performance: Fannie Mae data shows refinance borrowers averaging $1,000+ in savings when AOLs replace lenders’ policies—consistent with the cost comparisons shown in our interactive map above.

3. Regulatory Framework and Professional Oversight

AOLPro providers operate under dual regulation:

- Licensed attorneys subject to state bar oversight and professional liability requirements

- Insurance wrapper regulated by state insurance departments for claims processing

Claims resolution: Providers report typical claim resolution timeframes of 3-4 months, compared to the often-lengthy processes associated with traditional title insurance disputes.

The AOLPro Strategic Advantage: For borrowers and investors seeking the cost savings we’ve outlined without the complexity of navigating state-specific discount programs and shopping multiple providers, AOLPro offers a simplified path to substantial savings—particularly valuable in the high-cost states highlighted in our interactive title insurance costs by state map.

You Save on Title Costs

With AOLPro?

Before You Decide: Key Considerations and Disclosures

Coverage Isn’t Identical

While AOLs and traditional title insurance both protect against title issues, they work differently. AOLPro provides attorney-backed opinions with insurance coverage, while title policies offer direct insurance protection. Review the specifics with your lender to understand which option fits your situation.

Get Real Quotes for Your Property

Our cost estimates reflect typical market rates, but your actual costs depend on your specific property, location, and chosen providers. As we’ve emphasized throughout this guide, always compare itemized quotes from multiple sources.

Regulations and Lender Acceptance Vary by State

Title insurance costs and customs differ significantly by state, as we’ve detailed throughout this guide. While AOLPro is available in all 50 states, lender acceptance can vary depending on your specific loan program and financial institution. Reach out for our current list of participating national lenders, or consult local professionals familiar with your area’s requirements.

This Information Is Not Legal Advice

We’re providing educational content to help you make informed decisions. For guidance specific to your situation, consult licensed real estate attorneys, experienced agents, or financial advisors familiar with your state’s laws.